Star Health Insurance as Star Wellbeing and Partnered Protection started its tasks in 2006. It is India’s first independent medical coverage supplier and offers an extensive variety of reasonable health care coverage items for people, families, and organizations. Since its foundation, Star Wellbeing has enormously developed its tasks, with 830 branches the nation over.

Star Health care coverage plans cover policyholders’ clinical check-ups, AYUSH frameworks of medications, basic diseases, and hospitalization costs. Moreover, the policyholders of Star Wellbeing are likewise qualified for Covid inclusion.

Key Elements of Star Wellbeing Basic Disease Insurance Contract

Star Wellbeing basic protection accompanies specific elements. Key elements of the arrangement are as per the following:

- Convenience choice

- Deep rooted inexhaustibility

- Credit only treatment

- Limits on expenses

- In-house guarantee process

The advantages of Star Wellbeing basic ailment strategy are complex. With basic disease plans, you could not just benefit great quality treatment at any point yet in addition get saved from bearing the weighty monetary weights yourself during troublesome times.

Star Medical coverage Charge Estimation

An expense is a sum paid by policyholders to the safety net provider in return for health care coverage inclusion. The Star Medical coverage expense not entirely settled based on a few elements.

- Wellbeing History: Your wellbeing history is one of the components that influence the top notch measure of your Star Health care coverage plan. In the event that you have any prior ailments, you should pay a higher premium.This is on the grounds that in such cases, the insurance agency faces higher possibilities committing a case in contrast with policyholders who are fit and fine.

- Number of Individuals Covered: The superior sum for the Star Wellbeing strategy would be less in the event that you purchased a singular health care coverage plan. In any case, in the event that you decide to add your other relatives as floaters, you should pay a higher premium as you require more inclusion.

- Progress in years: As you age, you become more inclined to illnesses and thus have more prominent possibilities making claims under the medical coverage plan presented by Star Wellbeing. In this way, you should pay higher charges in the event that you purchase plans in your advanced age when contrasted with your young age.

- Total Protected: You get a bigger inclusion when you pick the higher aggregate guaranteed Star Wellbeing Strategy. Thus, you might need to pay a higher premium against your arrangement.

- Way of life: Undesirable way of life propensities like smoking, drinking, and others put a person at extraordinary gamble of getting illnesses, bringing about higher possibilities making claims. In this way, you might need to pay a higher expense against your Star Health care coverage.

Star Health care coverage Strategy Subtleties

The Star Wellbeing Strategy covers you against various sicknesses and ailments. Here is a rundown of the main 5 plans presented by Star Wellbeing.

- Star Family Wellbeing Optima Strategy: It is a family floater health care coverage plan that gives inclusion to the whole family under a solitary total guaranteed. The arrangement covers costs connected with air ambulances, pre-hospitalization, post-hospitalization, and different expenses. The policyholders can pick the aggregate guaranteed, which goes from Rs. 1 lakh to Rs. 25 lakhs relying upon their necessities.

- Star Thorough Health care coverage Strategy: It gives inclusion to people matured between 90 days and 65 years. The arrangement is accessible with next to no sub-limit or covering. Besides, it covers costs caused because of clinical meeting, domiciliary hospitalization costs, childcare treatment, and that’s just the beginning.

- Star Medi Exemplary Insurance Contract: Medi Exemplary Protection Contract is a singular health care coverage contract that shields you from hospitalization costs caused because of any ailment, affliction, sickness, or mishap. You can be covered under this strategy in the event that you are matured between 5 months and 65 years. The arrangement offers a few inclusion highlights, including childcare medicines, wellbeing check-ups, non-allopathic medicines, in-patient hospitalization inclusion, and emergency vehicle charges.

- Star Senior Residents Honorary pathway Health care coverage Strategy: Star Wellbeing has planned this arrangement to take special care of the novel necessities of senior residents. The strategy offers a long lasting sustainability include and can be bought either on an individual or floater premise. The age of the policyholder ought to run somewhere in the range of 60 and 75 years. A few costs covered under this Star Wellbeing strategy incorporate pre-hospitalization, post-hospitalization, wellbeing check-ups, and others.

- Youthful Star Insurance Contract: Policyholders can buy this plan either on an individual or family floater premise. The base total guaranteed for this plan is Rs. 3 lakh and the greatest is Rs. 1 crore. The Youthful Star Insurance Contract gives inclusion to costs caused because of in-patient hospitalization, street emergency vehicle, pre-hospitalization, and others.

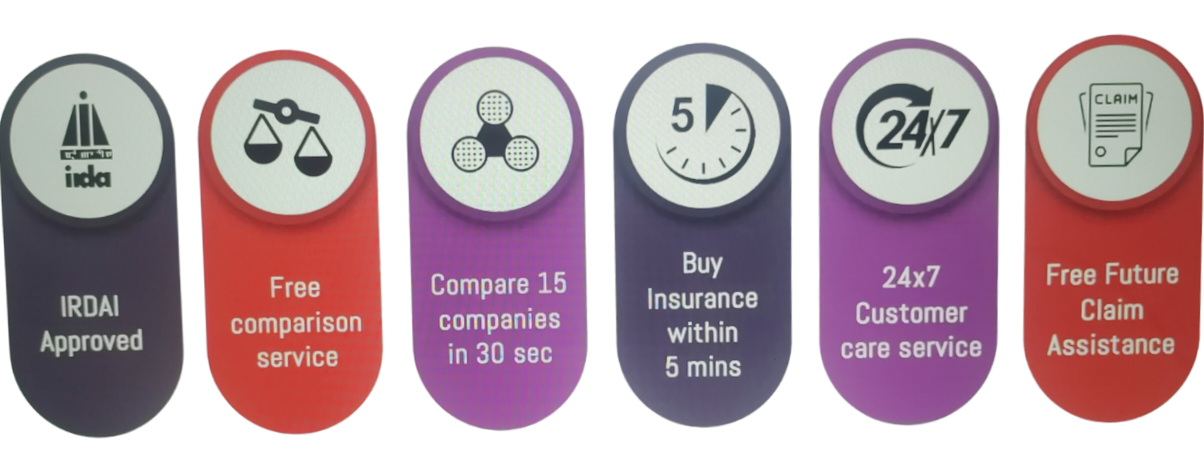

Why Pick Star Health care coverage?

Star Wellbeing is one of the most amazing insurance agency in India. Here are a few advantages of putting resources into Star Medical coverage plans.

- Network Clinics: Star Wellbeing is related with more than 14000 emergency clinics, centres, and wellbeing associations to give credit only treatment offices to policyholders. During a health related crisis, you can find and visit the closest organization emergency clinic to try not to take care of weighty hospital expenses.

- Whenever Help: One more benefit of buying a Star Wellbeing strategy is that you get whenever help from the client service group. Whether you need to find an organization medical clinic or start a case settlement process, you can contact the organization’s help group whenever.

- Add-on Advantages: Star Wellbeing gives extra advantages like riders to give improved inclusion to policyholders. You can browse various riders, for example, basic ailment riders, premium waiver benefit riders, and others.

- Numerous Plans: The policyholders can pick between various health care coverage intends to take care of their novel requirements. A few sorts of wellbeing plans presented by Star Health care coverage incorporate family floater wellbeing plans, individual wellbeing plans, and gathering health care coverage.

Network Medical clinics of Star Health care coverage

An organization medical clinic works in relationship with an insurance agency to offer credit only therapy to policyholders. Star Health care coverage has tie-ups with more than 14,000 organization emergency clinics the nation over. The policyholder can find and visit these Star Wellbeing network medical clinics for credit only therapy. You should simply illuminate your safety net provider about your hospitalization, and the emergency clinic will straightforwardly settle the emergency clinic treatment bills with them.

Guarantee Interaction of Star Wellbeing

Star Wellbeing offers two kinds of guarantee repayments – credit only and repayment. Follow the moves toward raise a case:

Credit only Case Interaction Re-imbursement Cycle

Credit only Interaction

Stage 1: Track down network emergency clinic

- Find the closest organization medical clinic of Star Wellbeing

- Get owned up to the emergency clinic

Stage 2: Illuminate Star Wellbeing

- Advise the insurance agency about the hospitalization

- In the event of pre-arranged hospitalization, close the back up plan before medical clinic affirmation.

Stage 3: Get Pre-approval

- Top off the pre-approval structure and submit it to the clinic staff

- The pre-approval structure will be shipped off Star Wellbeing for endorsement.

- Once endorsed, acquire clinical treatment.

Stage 4: Emergency clinic Release

- At the hour of release, sign every one of the clinical reports.

- Pay for the things/administrations not covered under the Star Wellbeing strategy

Stage 5: Guarantee settlement

- The organization medical clinic will send the clinic bill to Star Wellbeing.

- After survey, the insurance agency will take care of the bill sum straightforwardly to the organization clinic.

Star Medical coverage Clinics Rundown in India – State-wise

- Andaman And Nicobar

- Andhra Pradesh

- Arunachal Pradesh

- Assam

- Bihar

- Chattisgarh

- Dadra and Nagar haveli

- Daman and Diu

- Delhi

- Goa

- Gujarat

- Haryana

- Himachal Pradesh

- Jammu and Kashmir

- Jharkhand

- Karnataka

- Kerala

- Madhya Pradesh

- Maharashtra

- Manipur

- Meghalaya

- Mizoram

- Nagaland

- Odisha

- Pondicherry

- Punjab

- Rajasthan

- Odisha

- Pondicherry

- Punjab

- Rajasthan

- Sikkim

- Tamil Nadu

- Telangana

- Tripura

- Uttar Pradesh

- Uttarakhand

- West Bengal